Road Tax Check | Verify Your Car Tax Status

- Lowest price check

- Great Customers Review

- Fast and Accurate

What is a Car Road tax? What do you need to Know

Car road tax, also known as vehicle excise duty (VED), is a tax that vehicle owners must pay to use their vehicles on public roads in the UK. The amount of tax varies based on factors such as the vehicle’s engine size, fuel type, CO2 emissions, and age. It is important to know your when your tax expires to ensure that you are legally compliant and avoid potential fines or penalties for driving without a valid road tax. Checking your vehicle tax status and makig sure it is up-to-date is easy and can be done online with SmartCarCheck.

How Do I know If My Vehicle is Taxed?

SmartCarCheck is a provider that offers an accurate check tool to help vehicle owners or prospective buyers easily determine the road tax status of a vehicle. With the SmartCarCheck check tool, car owners, sellers, and buyers, can input the vehicle registration number (license plate number) of any car andquickly determine if the car is taxed or not.

How To Check Car Road Tax and MOT History

To check a car road tax with Smart Car Check, you need to follow these steps:

- Go to the Smart Car Check website.

- Enter the vehicle’s registration number in the search bar on the homepage and click “Search”.

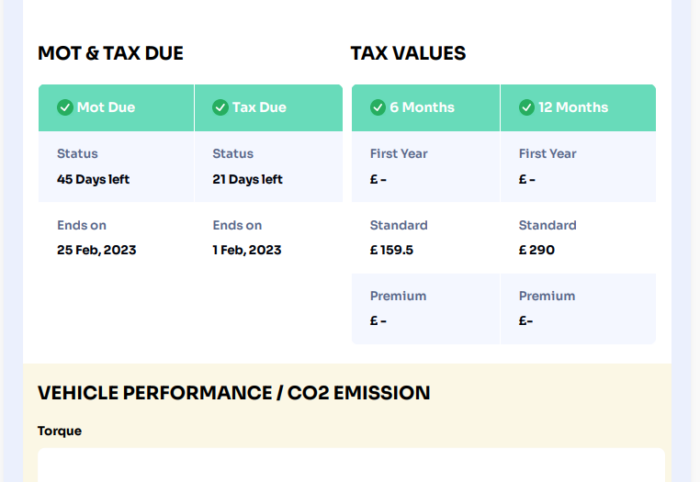

- Smart Car Check will provide you with detailed information about the vehicle, including its car tax status.

- If the vehicle is taxed, Smart Car Check will show you when the car’s tax is due.

- If the vehicle is untaxed or has a SORN (Statutory Off-Road Notification) status, Smart Car Check will indicate this as well. Smart Car Check will also provide information on MOT status, mileage history, and other important details about the vehicle. By using Smart Car Check, you can easily check any UK vehicle road tax status and ensure that you are legally compliant to use a vehicle you’re buying on public roads.

What Is Included in Our Car Tax Check?

A Car Road Tax Check typically involves verifying whether a vehicle has valid road tax or not. This check includes:

- Checking the vehicle’s registration number to ensure it’s correct and matches the DVLA records.

- Verifying the vehicle’s road tax status by checking whether it is taxed, untaxed or has a Statutory Off-Road Notification status.

- Checking the expiry date of the current road tax.

- Checking the vehicle’s MOT status to ensure it has a valid MOT certificate (if applicable).

- Checking the vehicle’s insurance status to ensure it is insured for use on public UK roads.

Performing a car tax check is important to ensure that the vehicle is roadworthy, legally compliant, and does not pose a risk to other drivers on roads in the United Kingdom.

Can I Renew My Road Tax Without Insurance?

No, you cannot renew your road tax without insurance. In your vehicle is registered in the UK, it is a legal requirement to have valid insurance to use a vehicle on public roads. The DVLA requires proof of insurance before issuing road tax. Therefore, you need to have valid insurance before you can renew your road tax. If the vehicle is uninsured, you must obtain insurance before renewing your road tax. Failure to have valid insurance and road tax can result in fines, penalty points, and even seizure of the vehicle. So, make sure to carry out tax and MOT check and be sure that your vehicle has up-to-date car tax.

Car Tax Checker: How is Road Tax Calculated?

Road tax in the UK, also known as vehicle excise duty (VED), is calculated based on several factors. These factors include:

Vehicle type: Different types of vehicles are taxed at different rates. For example, electric vehicles are often exempt from road tax, while diesel cars with higher emissions may be taxed at a higher rate.

CO2 emissions: The amount of road tax you pay is largely based on your vehicle’s CO2 emissions. The higher the emissions, the more road tax you will pay.

Fuel type: Road tax rates are also affected by the fuel type of the vehicle. For example, diesel cars may be taxed at a higher rate than petrol cars due to their higher emissions.

Vehicle age: Are you buying a used vehicle? The age of the vehicle will also affect the road tax rate. Newer vehicles may be subject to higher road tax rates than older vehicles.

The amount you will pay can be calculated using the vehicle’s CO2 emissions and fuel type. The UK government provides an online road tax calculator that allows you to enter a vehicle’s details and determine how much road tax you will need to pay. It is important to note that the road tax rates can change annually, so it is essential to check the current rates before making any calculations.

Car Tax Checker: How is Road Tax Calculated?

Did you receive a DVLA reminder letter? It’s important not to overlook it. Check when your car tax is about to expire using registration check services online. Plan ahead for tax renewal before the expiration date by renewing it online as soon as necessary. Also, consider your vehicle’s MOT expiry date and coordinate both renewals. Set electronic reminders to stay organized and avoid unintentional lapses in compliance. By taking prompt action and staying proactive, you can ensure your vehicle remains legally compliant and roadworthy.

Frequently Asked Questions (FAQs)

How can I check my car's road tax expiry date?

You can check your car’s road tax expiry date by visiting the Smart Car Check reg number check tool. This way, you can gain full access to your vehicle’s tax information. If you need a free car check, you can utilize the DVLA website. However, the results from a free tax check will not be as comprehensive as our concise reports.

How do I renew my road tax?

You can renew your road tax online, by phone, or at a post office. To renew online, you need to visit the DVLA’s website (gov.uk) and follow the instructions. You will need your vehicle’s registration number, MOT test number (if applicable), and a valid insurance policy.

What happens if I don't renew my car's road tax?

If you don’t check the car tax and renew it, you may be fined, receive penalty points on your license, or even have your vehicle clamped or seized. It is a legal requirement to have valid road tax to use your vehicle on public roads in the UK.

Can I get a refund on my car's road tax?

If you sell your car or take it off the road (SORN), you may be eligible for a road tax refund for any full month of remaining tax. To claim a refund, you need to notify the DVLA of the sale or SORN status and provide the vehicle’s registration certificate (V5C).

Is road tax the same as car insurance?

No, road tax and car insurance are two separate things. Road tax is a tax that you pay to use your vehicle in the UK, while car insurance is a policy that protects you financially if you are involved in an accident or your car is stolen. Both are legal requirements for using a vehicle on public roads in the UK.

Do you pay road tax on electric cars?

In the UK, electric cars that produce zero emissions are exempt from road tax, also known as vehicle excise duty (VED). This exemption was introduced to encourage people to switch to cleaner, more environmentally friendly vehicles. However, electric vehicles with a list price of over £40,000 are subject to a supplementary luxury car tax for the first five years of registration, which is currently £335 per year. This means that if an electric car’s list price exceeds £40,000, the owner will need to pay the supplementary tax in addition to the standard road tax if they wish to drive the car on public roads.